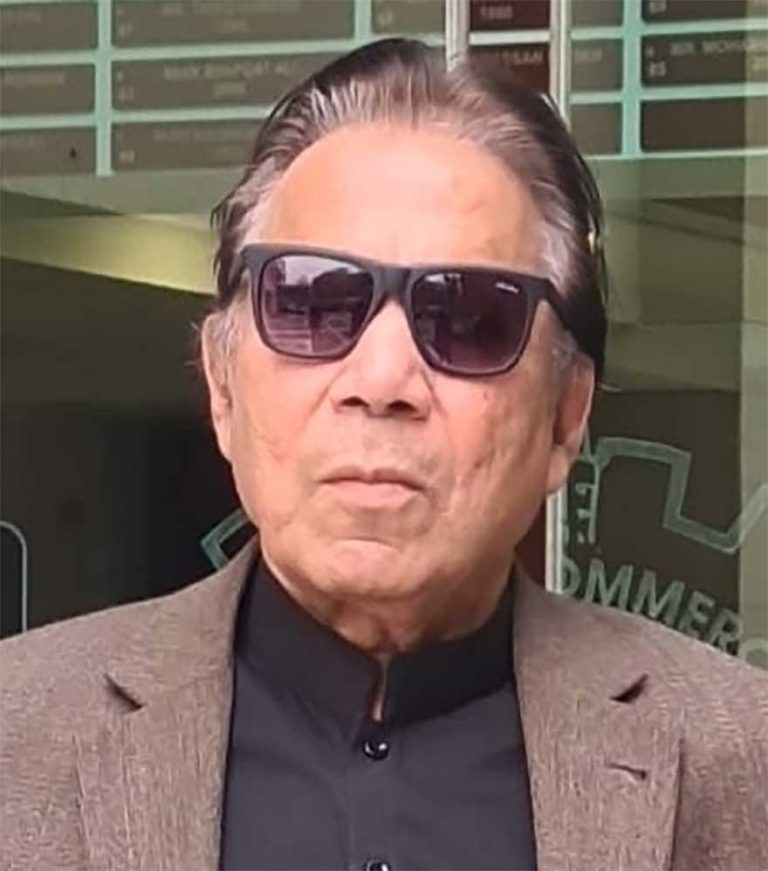

By LCCI President Faheem-ur-Rehman Saigol

As president of the Lahore Chamber of Commerce and Industry, I have observed Pakistan’s economic journey in the year 2025 unfold with both optimism and caution. It has been a year of visible macroeconomic stabilization, refreshing signs of renewed confidence, and positive economic sentiment. But alongside this progress, deep-rooted structural challenges continue to test the strength of our economy and the resilience of our business community.

Read also: Pakistan–US exports can be increased to $10 billion: LCCI president

This year-end reflection is therefore not merely a celebration of economic numbers, but a call to action, a reminder of unfinished work, and a business community’s voice urging meaningful continuity and reform.

Pakistan began 2025 burdened by many legacy issues: high inflation, soaring interest rates, dwindling reserves, a credit-starved market, and a private sector operating on survival mode. Over the past 12 months, signs of revival have emerged, many of which must be acknowledged for the confidence they are gradually rebuilding.

The most powerful indicator of renewed trust has come from overseas Pakistanis. Remittances surged to US$ 38.3 billion in FY 2024–25, up from US$ 30.3 billion the previous year—an increase of 26 percent. Diaspora remittances are not merely financial transfers, they are a vote of confidence in the systems of the country. In just the first five months of FY 2025–26 (July–November), inflows have already touched US$ 16.1 billion, up more than 9 percent from the same period last year. This reversal of trend reflects improved market sentiment, clarity of direction, and better compliance mechanisms to shift flows from informal to formal channels.

Inflation is another area where the biggest relief has been felt by the people and by businesses. After one of the harshest inflationary cycles of our history, average inflation fell dramatically to 4.5 percent in FY 2024–25, compared to 23.4 percent last year. This alone has eased pressure on households, revived retail demand, lowered the working capital stress of industries, and signaled that Pakistan may finally be emerging from a cycle of painful cost escalation that crippled growth for nearly two years.

The stock market has perhaps been the loudest expression of revived confidence. The KSE-100 Index crossing 170,000 points—up from nearly 105,000 a year ago—represents more than 60 percent growth in market capitalization. The business community, industrial groups, investors and banks have all begun repositioning for growth, and this is a reality that must be strengthened and protected at all costs.

On the financial stability front, foreign exchange reserves rising above US$ 21 billion—up from US$ 15.9 billion last December—represent a nearly 32 percent improvement. Pair this with the successful receipt of a US$ 1.2 billion tranche from the International Monetary Fund in December 2025, and it becomes clear that global institutions have regained confidence in Pakistan’s reform direction. This is a unique opportunity—one that must not be allowed to slip away through policy inconsistencies or administrative reversals.

Interest rate reduction remains the single most consequential development for private-sector revival. A policy rate that has dropped from 22 percent to around 10.5 percent is a turning point. High borrowing costs had frozen expansion plans, stalled SME growth, and forced many industries to cut production. As rates normalize, we expect a new investment cycle to begin—provided reforms continue and energy costs are addressed.

Meanwhile, IT exports—Pakistan’s most promising sunrise sector—continued to post remarkable performance. With a 19 percent increase in the first five months of FY 2025–26 reaching US$ 1.8 billion, our digital economy is finally stepping into its role as a foreign exchange generator and global service provider. We must now scale this momentum by enabling freelancers, reforming taxation for tech exports, and upgrading digital infrastructure.

Policy decisions such as abolishing the 0.25 percent export development surcharge and completing the privatization of PIA in 2025 reflect a welcome seriousness. SOE losses have drained the national exchequer for decades, and reducing the fiscal footprint of state enterprises is essential to freeing resources for development.

Similarly, the launch of the “Uraan Pakistan” five-year economic transformation program in late 2024 must be acknowledged as a forward-looking step. Its early impact in moderating inflation and stabilizing external accounts is visible. But the real test will be execution over the remaining four years.

Yet amid this progress, Pakistan’s business community continues to face daunting challenges. Rising cost of doing business—particularly energy tariffs—remains our number one concern. While inflation has fallen and interest rates have eased, electricity and gas costs remain among the highest in the region. For industries in Punjab especially, the energy price differential with regional economies continues to erode competitiveness.

The trade deficit remains a major red flag. In the first five months of FY 2025–26 alone, it widened to US$ 15.4 billion—up 37 percent compared to the same period last year. This means that while macroeconomic indicators improve, our export fundamentals remain weak. No economy can grow sustainably with an ever-widening external gap. Pakistan must move beyond export rhetoric and into export transformation—industrial zones, market access, export financing incentives, and competitive tariffs must form the core of policy.

Investment continues to stagnate. Net foreign direct investment stood at US$ 2.49 billion in FY 2024–25, barely 5 percent higher than the previous year. This marginal increase tells us that global investors remain cautious and are waiting for deeper, sustained reforms before committing capital.

Most worrying of all is the persistent narrowness of our tax base. A tax-to-GDP ratio stuck at 10 percent and fewer than six million taxpayers carrying the burden of a population of 240 million is not a model that can sustain growth. Without reforming documentation, institutional efficiency and tax fairness, Pakistan’s fiscal challenges will continue to resurface, no matter how much multilateral support arrives.

As LCCI president, I believe 2025 will be remembered as a year of stabilization—where Pakistan stepped back from the edge and began reclaiming economic space. But 2026 must become the year of growth. Stabilization without growth brings no jobs, no industrial expansion and no prosperity for our people.

We therefore urge government to adopt several priorities:

– immediately reduce energy tariffs for export and manufacturing sectors

– sustain low interest rates and provide long-term financing windows

– fully implement tax reforms focused on broadening the base, not burdening the compliant

– adopt an export-first policy aligned with market access and value-added manufacturing

– ensure every long-term economic reform is protected from political change

Pakistan’s business community stands ready to lead, invest and create. What we need is continuity of policy, fairness of treatment, and a government that enables rather than obstructs enterprise.

The story of 2025 is one of recovery. The story of 2026 must be one of expansion and transformation. Our economy has taken its first breath again—now it must begin to run.

— president, Lahore Chamber of Commerce and Industry